Bluebox Creative Industries Report

Tuesday, 10 October 2017

M&A Update

October 2017

Industry Update

The ‘Creative Industries’ sector includes businesses operating in film, television, music, advertising and publishing. The sector currently makes up approximately 4% of the UK economy and is also one of the fastest growing sectors in terms of both job and value creation. Alongside their vital economic role, these industries help mould the UK’s global brand, shaping investment, tourism, and cultural influence. As a leader in the creative sector the UK holds a formidable position internationally and looking forward, the industry is likely to withstand economic troubles with greater ease than many others.

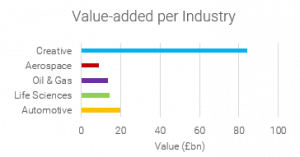

The creative industries now employ almost 2 million people in the UK (3 million including creative roles in non-creative companies) and the rate of job growth within the industry is over four times higher than the wider economy. For the five-year period from 2010 to 2015 the value created by creative firms increased by over a third, compared to less than five per cent for the wider economy. An analysis by accounting firm PwC[1] showed that, in 2015, the value generated by creative industries in the UK comfortably eclipsed the value of the automotive, life sciences, oil & gas and aerospace industries combined.

[1] Creative Industries Federation

Recent Activity

Unsurprisingly looking at the size and the growth of the creative industries in the UK, there has been a large amount of M&A activity so far this year; approaching 40 transactions, with an average disclosed deal value of £83 million (median: £16.5 million). Valuations have been strong, with disclosed deal values being on average 8.1x a company’s EBITDA, compared to 6x to 7x for the deals across other sectors.

Target firms can be broken down primarily into three core groups: advertising, music, TV & film and publishing. The graph below shows the mix of these. The data shows that activity has been most prevalent within the advertising sub-sector. This is not unexpected as the industry is dominated by a few very large players (WPP, Omnicom, Publicis, Interpublic, Havas and Dentsu Aegis) and we have seen that after successful professionals set up their own shop, they typically look to sell it back to one of the larger operators.

Target firms can be broken down primarily into three core groups: advertising, music, TV & film and publishing. The graph below shows number of M&A transactions in each of these. The data shows that activity has been most prevalent within the advertising sub-sector. This is not unexpected as the industry is dominated by a few very large players (WPP, Omnicom, Publicis, Interpublic, Havas and Dentsu Aegis) and we have seen that after successful entrepreneurs set up their own shop, they typically look to sell it back to one of the larger operators.

The 5.4% represented by the ‘Other’ category includes deals involving Outfit-7, a children’s videogames developer, who were acquired by a Chinese consortium and GMF Media, a sports media group, that was acquired by Canadian machine learning group, Breaking Data Corporation.

Industrial Strategy

As part of the government’s preparation ahead of a full unveiling of an industrial strategy, the Conservative Government has announced their intent to support the UK creative sector. The ‘Independent Review of the Creative Industries’[2] overseen by ITV chairman, Peter Bazalgette, proposed the removal of barriers to finance, the creation of trade opportunities and initiatives to attract young talent into the industry. The government has already announced the Creative Cluster Programme which will invest £80 million into eight creative research & development partnerships. The report highlighted the need to be especially mindful of the sector at the moment as there is a “real risk of a post-Brexit creative brain drain.”

Digital Media

The recent rapid growth in the adoption of new digital media platforms is set to continue in the coming years due to increasing demand for eBooks, digitally streamed media content, video games and online advertising.

This continued transition away from traditional physical media is expected to fuel to the UK’s entertainment and media industry going forward and the sector is now forecast to grow at a compound annual rate (CAGR) of 4%, reaching £66 billion by 2019. Tablet-read eBooks are expected to enjoy a CAGR of 20% up to 2020, meaning electronic books will be ahead of print for the first time by 2018. Advertising revenues from music streaming services are also expected to overtake radio advertising within the next couple of years as well.

Mobile Advertising

Whilst desktop internet advertising is continuing to grow, companies are increasingly focusing on capturing a consumer’s attention where they spend most of their digital time – their mobile device.

Investment into mobile advertising has increased by more than 270% in the past four years and has increased by a factor of 18 since 2011, reaching £3.7 billion in 2017. Mobile advertising is predicted to continue to be the area of focus for a company’s digital footprint.

Digital advertising spending is increasing across all sectors, but especially in retail, automotive and consumer goods where annual spending increases on digital adverts are expected to be above 11%.

Who’s Buying?

Unlike other sectors in the UK, most of interest for creative companies in the UK has come from other UK-based firms, with over 60% of acquisitions this year being made by larger UK companies. Other European countries account for 16% of acquisitions, US firms made up 8% with the remainder coming from Asia.

Most of these transactions were made by other operators within the creative industries, with private equity only accounting for 8% of transactions. The rationales given for making the acquisitions were generally either to expand or diversify the acquirer’s current service offering or an expectation of the deal to be accretive to their earnings. As an example, Netflix’s acquisition of Millarworld was to capture the comic book publisher’s body of work in the hope of creating further successful film and TV properties.

Both Next Fifteen and All3Media have made multiple transactions in the sector in 2017. Next Fifteen has expanded their marketing capabilities, acquiring Elvis Communications and Velocity Partners as well as market research consultancy Charterhouse Research. All3Media is a TV production company that has expanded its content library through Betty & Raw TV and Two Brothers Pictures.

| Date | Acquirer | Target | Description | Deal Value |

| Sep 2017 | Next Fifteen Communications Group | Charterhouse Research | Financial market research | Undisclosed |

| Sep 2017 | Next Fifteen Communications Group | Elvis Communications | Communications agency | £6m |

| Sep 2017 | Once Upon A Time London | MJ Media Agency | Media planning agency | Undisclosed |

| Sep 2017 | ZPG | Ravensworth Digital Services | Marketing & print services | Undisclosed |

| Aug 2017 | WPP | Design Bridge | Brand design agency | Undisclosed |

| Aug 2017 | DEAG Deutsche Entertainment | Flying Musical Company | Theatre production company | £5m |

| Aug 2017 | Bluefocus Communications | We Are Very Social | Social media agency | £8m |

| Aug 2017 | Netflix | Millarworld | Comic book publisher | Undisclosed |

| Jul 2017 | Sultan Mohamed Abuljadayel | Independent Digital News and Media | Newspaper publisher | Undisclosed |

| Jul 2017 | Peninsula Business Services | Wolters Kluwer Legal & Regulatory | Legal publishing division | £12m |

| Jul 2017 | Graphite Capital Management | Random42 Digital Healthcare Agency | Healthcare digital marketing | Undisclosed |

| Jul 2017 | Key Capital Partners | MC&C Media | Media planning agency | £7m |

| Jul 2017 | Next Fifteen Communications Group | Velocity Partners | B2B content marketing | £6m |

| Jul 2017 | Future Publishing | Ascent Publishing | Magazine publisher | £32m |

| Jul 2017 | Centaur Media | MarketMakers Incorporated | Integrated marketing services | £14m |

| Jul 2017 | Huntsworth | The Creative Engagement Group | Experiential marketing firm | £25m |

| Jun 2017 | Advantage Smollan | Intermarketing Agency | Advertising agency | Undisclosed |

| Jun 2017 | Concord Bicycle Music | Imagem Music Group | Music publisher | Undisclosed |

| Jun 2017 | Metropolis International Group | EMAP Publishing (11 Heritage Brands) | Publishing brand operator | £24m |

| May 2017 | Antena 3 de Television | AMG Advertising Topco | Online advertising services | Undisclosed |

| May 2017 | All3Media | Betty TV | TV production company | Undisclosed |

| Apr 2017 | Lliffe Media | KM Media Group | Newspaper publisher | Undisclosed |

| Apr 2017 | The Hut.com | Hangar Seven | Marketing services | Undisclosed |

| Apr 2017 | Kingston Acquisitions | New Scientist | Science magazine publisher | Undisclosed |

| Apr 2017 | Mayfair Equity Partners | Talon Outdoor | Integrated marketing agency | Undisclosed |

| Apr 2017 | PA Group | Stream UK Media Services | Video production | Undisclosed |

| Mar 2017 | Banijay Entertainment | Castaway TV Productions | TV production firm | Undisclosed |

| Mar 2017 | Matthews International | Equator | Marketing and design agency | £31m |

| Mar 2017 | Sandhills East | Moffat Publishing | Construction publication | Undisclosed |

| Feb 2017 | Lagardere Active SAS | Shopvolution | e-Retailing publisher | Undisclosed |

| Feb 2017 | TBWA Worldwide | Lucky Generals | Advertising agency | Undisclosed |

| Feb 2017 | All3Media | Two Brothers Pictures | TV production firm | Undisclosed |

| Feb 2017 | Breaking Data Corp. | GMF Media | Sports media group | Undisclosed |

| Feb 2017 | Kew Media Group | Frantic Films Corporation | TV production company | £70m |

| Feb 2017 | Suddeutscher Verlag | Ultima Media | Industry magazines publisher | £9m |

| Jan 2017 | Consortium led by Ou Yaping | Outfit7 Investments | Kid’s videogames developer | £790m |

| Jan 2017 | Wilmington Group | Health Service Journal | Health industry publisher | £19m |

| Jan 2017 | Hubert Burda Media | Immediate Media Company | Publishing group | £270m |

By Jamie Kerr, Senior Research Analyst at Bluebox