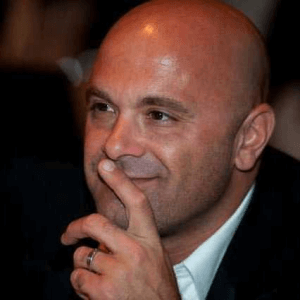

Entrepreneur Series – Interview with Michael Clapper former founder of Enterprise Group & VAPESTICK

Saturday, 3 September 2016

We get to know Michael Clapper, award winning and seasoned entrepreneur. Former Founder and CEO of Enterprise Group and VAPESTICK, Michael shares his experiences of building and selling two businesses in two very different industries.

- You’re a seasoned entrepreneur – what first inspired you to become an entrepreneur?

I would say it was my father who inspired me. He used to say that there are two types of people in this world. Firstly, there are those who have the cars, the holidays, and the houses they can afford. Then there are those who have the cars, the holidays and the houses they want. The first group are employed people and the second are self-employed. He drilled into me, from a very early age, that it doesn’t matter how well you do as an employee in any company, your earnings potential will always ultimately be capped, at however high a level, and you will always be beholden to others for your income and long term security.

As a self-employed person, there is literally no limit to what you can achieve, it just depends on how hard you’re prepared to work for it. He said this to me early on in life and it really struck a chord, so as soon as I left university, I set off to work for myself. Sometimes I’ve been very grateful for his advice, other times not so much! When you are entirely dependent on your own performance delivery, there’s never any respite from that, particularly as your responsibilities grow. The trick is to try and ensure the rewards make the additional stress worthwhile.

- Do you think it takes a certain type of personality to do it?

Yes, I think it does. To be a successful entrepreneur, you need to be genuinely passionate about what you’re doing, with an unwavering belief in your own ability to make positive things happen in your chosen field. You can’t have the mentality that business will just come your way. Opportunities need to be continually identified and seized, or you can bet one of your competitors will. You need to be the type of person who always prepares for the worst-case scenario, which in turn inevitably leads to best practices throughout your business. As long as you remain hungry, highly active, and confident in your ability to succeed, positive results tend to follow.

- What do you wish you knew before you started your own business?

Where to start! [Laughs] There are so many different moving parts to any business; the more you experience, the more you learn and the more effective you ultimately become. No-one can start out knowing it all. You really can’t beat experience, and mistakes are valuable in themselves. Some of the biggest lessons I ever learned were from the mistakes I had made along the way, which I didn’t want to repeat!

I suppose the biggest lesson would be to try and avoid committing to significant fixed overheads until they become absolutely essential to the continuation or growth of your business; whether that be leases, salaries or anything else of significance. You never know what the future is going to bring and things can change rapidly and unexpectedly. Once you are committed to heavy fixed overheads, they can serve to break your business when the inevitable issues arrive – a prime example for me was the onset of the credit crunch when I was involved in the mortgages & loans industry, and where my entire business found itself with nothing left to sell, almost overnight. What I would have given at that stage to not have had any long leases, or 135 staff on our payroll.

- Do you believe there is some sort of pattern or formula to becoming a successful entrepreneur?

I think so. Firstly, you have to believe, totally and passionately, in what you’re doing and in your ability to make it a success. You can’t be successful half-heartedly. You need to be 100% committed, and have a deep and ever-growing understanding of your chosen field, along with all the various aspects of growing and running your business.

I also think it is about constantly looking forwards and planning for the future wherever possible. I always try and look forward around two years, because that is a reasonable amount of time to make educated assumptions as to what your marketplace will likely look like, given the trends and developments happening right now. If you build your business to be well-positioned for your vision of the future, if and when those events materialise you’ll find yourself in a very strong position. That was the secret to my success in both of my major businesses. In the finance sector, I was looking forward to imagine what would be important to brokers & broker networks post-regulation, and in the e-cigarette sector, it was the anticipated arrival of the tobacco companies and other potential acquirers, that I believed would arrive once the market became more established and regulatory environment determined.

- What three things would you tell your former self when starting a business?

- Delay any significant fixed overhead commitments until absolutely business critical – for the reasons I’ve explained.

- Try to surround yourself with the right kind of people. Whilst some people can be very talented, and have strong CVs, they are not always the right fit for your leadership style, or for the ethos of your company. It is essential to lose the wrong people fast, and only retain positive and talented people around you. You don’t want ‘yes people’ at all, but you do want people who share your vision for the future of the business. I’ve been extremely fortunate to have found and retained a team of such people, and they have stuck with me over the past 15 years across my various ventures.I learned this lesson in my first major business, a finance company on brink of enormous expansion. I recruited some highly experienced and expensive individuals, with amazing CVs, to help expand the business, assuming that I and my team, who had never ran such a large business, would not be able to handle it ourselves. Within 6 months (and after great cost) I realised that these people were no use at all in building a fast growth business. They were no doubt hugely competent in operating within established corporates, but not right for the growth and expansion phase of a small business, in its evolution to becoming a much larger one. It turned out that my original, more inexperienced team, ultimately did a far better job of it, after I eventually let those big-hitters go. It was a very expensive and unnecessary mistake!

- Get a strong basic understanding of accounting, balance sheets and P&Ls early on, as it will stand you in good stead when growing and running your business. You can’t just leave it to accountants or bookkeepers to deal with – if these were talented entrepreneurs, they would be running their own businesses, not keeping records of what is happening in yours. I’ve been fortunate to build and sell two businesses. When you are ready to bring in investment, or exit, you will need to demonstrate how your business is run and how on top of the numbers you are. It is only once you have lived through a due diligence process, and the kind of meetings that involves, you realise how helpful it is to be on top of your numbers. Nobody cares about your business more than you do, and if you’re constantly looking at your cost lines and revenue trends you’ll have a much better view of what’s happening in your business, and what changes are needed.

- What’s the mantra you live by?

It’s better to burn out than to fade away – in other words always go for it, with everything you have, or you’ll never know what you would have otherwise achieved.

- Your first business was in mortgages, what made you want to start a business in E-cigarettes? Was it a steep learning curve to change industries?

After the credit crunch had ultimately put an end to my finance business, I was looking to try something entirely new, having spent 19 years spent in the finance industry. I had always been a heavy smoker, and my wife bought me a first generation e-cigarette she had found online. She gave it to me as a gift, from my soon-to-be-born daughter, and a card saying ‘Please Daddy I’d like to know you when I grow up, so start using this now!’. I gave it a go and I was blown away by it. I immediately believed this product had enormous potential. The problem was that I didn’t like the way the product looked, tasted or anything about it really, other than the imitation smoking experience. The next thing I knew, I was jumping on a plane to China and designing my own range of e-cigarettes!

It was a massive learning curve, but one I was excited to try, firstly because I so passionately believed in the product, and secondly because I had retained an unwavering belief in my own ability to adapt to anything, and lastly because the credit crunch had taught me something I had never considered previously. In the mortgage world, there had always been a healthy supply of mortgages. There had never been any kind of inventory issues until the credit crunch, when suddenly they all disappeared overnight. My business couldn’t recover from a scenario like that, whatever I might have tried. The e-cigarette business appealed to me because it was a business with physical stock. I could control whether or not I had any stock, and how much of it to hold at any time, and that was very appealing after the credit crunch! I soon found out that physical inventory brings with it a whole range of other major issues of course!

It was a very steep learning curve but once again I had surrounded myself with the right people, not necessarily experienced in FMCG, but all with a positive can-do attitude, who shared my vision for the business. We adapted, and we learned, and we ultimately built another very successful business together.

- Building a business on a product that involves the government and regulation must have its challenges. What were they and what advice do you have to other entrepreneurs in this space?

At the time we got involved there were no specific e-cig regulations, only generic consumer products regs – but there was a lot of talk about the need for regulation and even the possibility that these products might be banned outright.

Clearly that was a major risk, and we realised the industry needed a singular voice with which to argue the case for reasonable regulation. So we got together with some of the other early e-cigarette companies and formed what became the UK’s first e-cig trade association called ECITA. By doing this, we were able to combine our efforts and take our arguments to the government and other stakeholders. We were able to combine our resources to gain support, and to demonstrate that the industry was being run professionally and safely. This ultimately proved really effective and gave the very new industry some much-needed credibility. The members of ECITA were able to prove that they were complying with all relevant consumer products laws, as well as laws that didn’t even exist yet – for things like labelling, promotions, quality controls, age restrictions and safety testing.

If you’re in a regulated (or soon to be regulated) industry, my advice would be that it’s never a bad idea to find other companies in the same industry and try to form a group or trade association. You don’t need to share commercially sensitive information of course, but coming together in areas of mutual interest, and for the good of the industry as a whole, can only be valuable when executed well.

- You’ve successfully built and sold two businesses in two different sectors. Coming from different sectors, does that vary the sales process or is the process generally the same?

Different industries, but similar sales processes. Any business buyer or investor will always need to become happy with your numbers, trends, competitive landscape, longer term prospects & forecasts – whatever the business sector might be. Some of the factors under consideration vary of course, but as the business owner, you should be preparing your business for a full or partial exit from the very first day you start trading, with documented operational or board meetings, demonstrating solid corporate governance, and reviewing key performance indicators, as well as the competition, on a regular basis – from my experience its great practice for your business, and investors love to see it!

- What were your motivations for selling?

The two businesses carried different motivations. I had spent 19 years building my finance business called Enterprise Group, and had never intended to sell it. As the market evolved I had continually adapted the business – always trying to think and plan for two years ahead – and by 2007 I wanted to raise funds to continue the development of a fin-tech project we had been running. With eleven successful and related companies inside Enterprise, we were an attractive proposition to potential investors. We successfully raised £8.5m in April 2007, but the credit crunch forced a sudden halt to all our amazing plans, just 3 months after we completed the raise.

With VAPESTICK, my motivations were different. Again I wasn’t looking to sell the entire business, only to raise funds to be able to take the fight to the incoming tobacco companies and their deep pockets. I went out to raise money and consequently we met a company that wanted to buy us outright, which turned out to be the final outcome.

- What three tips do you have for business owners looking to sell their business?

- With every move you make today, try to imagine what it would look like to someone else in the years to come when they will assess your decision. Could you then justify a capex, or a contract you entered, or the pursuit of certain opportunities. Minute the expected outcome of your decision, and track the success or otherwise of that decision. If something wasn’t written down, it never happened! Be able to show that you think things through and track what happens thereafter. Always try to think how your decisions will appear to a third party looking at your business at any time in the future. From the first day of trading, be preparing your business for its ultimate exit. By doing that you’ll be adopting best practices for your business anyway.

- Timing is everything. You don’t want to sell your business too soon or too late, so my advice would be to watch the trends carefully. The ideal time to sell is when you are seeing impressive growth and you can realistically predict and explain future growth continuing. A business which is doing well but has clearly plateaued, won’t necessarily be an attractive purchase for many investors who seeking exciting growth prospects.

- Without blowing smoke (or vapour!) anywhere, find a strong corporate financial adviser! I’m happy to say that with the VAPESTICK sale I had a very good experience with Bluebox. It’s very useful to have an ally watching your back in all areas when it comes to selling. You certainly don’t want to be the bad guy when negotiating, so you need someone highly experienced in these types of negotiations, to sit between you and the potential buyer.

- What three key things have made you successful?

- I’m fortunate that I’ve always been a natural salesman, in the sense that I’m a quick reader of people, and am able to quickly understand what it is that gets different people excited. This has proved very useful to me over the years, in almost every business situation.

- Call me deluded, but I do have this unwavering belief in my ability to succeed in whatever I turn my mind to! Even when in doubt, I’m able to re-convince myself – probably because I’m a good salesman! See the link there? (Laughs). You can allow yourself those ‘woe is me’ moments, but you have to brush yourself down and find a way to get on and fix it. If you haven’t got, or can’t develop that ability then you shouldn’t really be running your own business, because whoever you are, and whatever business you’re in, it’s going to happen!

- Always try to treat others as you would like to be treated, whether you are on your way up in life, or if you’re on the way down. You never know when you might come across people again, for some reason or another, and it so often reap benefits, even many years later, if you have treated people right along the way. I have experienced this first hand countless times.

- Has being an entrepreneur affected your relationships with your friends and family?

Being a committed entrepreneur is all-consuming, and there is a danger that you are not ‘present’ with family and friends, even if you are physically present! You need to be able to switch off and say this is time for my family and I’m not going to think about the million work issues I have flying around in my head. It’s not easy and I still often struggle with it. This is something that has taken me many years to realise, and I have to remind myself of it often. It can be very difficult but it is so important…divorce would be so expensive! [Laughs] I have 3 amazing kids and I want to spend time with them while they still want to spend time with me – I don’t want to be the richest man in the cemetery, with kids that never really knew me, or me them.

My advice is to be 100% committed when you’re working, but when you’re not working, be 100% committed to not working!

- What motivates you to get up in the morning?

These days it’s about achieving long term security for my family and being able to give them the best possible opportunities in life. I want to always be able to provide for my family, and until I reach the point where I don’t have to worry about that anymore, I’m going to keep on going!

- Who do you look up to?

Anyone who has made a success of their lives ethically. Richard Branson and Simon Cowell are two people that jump out for me in a business sense. They’ve both lost it all, brushed themselves off and given it another shot, to come back stronger. You need to have knock-backs in life, or to sometimes take things right to the wire, so as to appreciate the good times fully when they come. The real measure of a person is how they deal with things when not going so well.

- Who would you most like to have dinner with and why?

Whilst a few people immediately spring to mind, I will go with the safest option and say my wife! She is always real with me, and lets me know when she’s proud, or when I’m being an idiot. In the early years of our marriage she hardly ever saw me, so these days I try to make up for that – although I’m not always certain which she actually prefers!

- If you weren’t an entrepreneur – what would you be?

I don’t think I could work for someone else – I can handle successes or failures by my own decisions, but not sure I could if by others. Otherwise, I’d become a professional tennis player.

Quick fire

- What’s your favourite book?

Not a Penny More, Not a Penny Less by Jeffrey Archer

- What do you do to chill out from a difficult day?

Tennis, swimming, walking, box sets and time with my 3 kids.

- What’s your breakfast for success?

Fruit ‘n fibre… or if I’m running really late, a banana and espresso!

- Sports team?

Team GB! Until I live somewhere else…

- Describe yourself in one word.

Bullish.

https://uk.linkedin.com/in/michaelclapper

https://www.linkedin.com/company/clapper-ventures-llp